Save Time and Money with Professional Bookkeeping Which Is Near You

Managing finances efficiently is crucial for any business. Hiring bookkeeping which is near you ensures accuracy, saves time, and reduces costs. Local professionals provide personalized support, helping you stay compliant and financially organized for long-term success. Understanding Bookkeeping Services Bookkeeping is an essential part of any business, ensuring accurate financial records, proper tax compliance, and […]

5 Rare Business Consulting Hacks for Rapid Growth

In today’s competitive market, every business owner wants to grow quickly. Yet, some strategies are not widely known but can make a huge difference. Here are five rare business consulting tips that could help your business grow faster than expected. These ideas are simple, practical, and based on real results. 1. Focus on a Niche […]

How is the cap rate calculated?

The capitalization rate is used in the commercial world to indicate the rate of return which is expected to be generated on a real estate investment property. The measure is based on the net income that the property is expected to generate on real estate investment property. Now you might ask, How do you calculate […]

Cost of Quickbooks Online

Quickbooks is a popular software for small businesses in 20204. It can be used for bookkeeping or spreadsheets grown in multi-headed hydra. You would need a better option than your present software. Quickbooks is a good choice as it doesn’t cost that much. In this article, we will discuss the cost of QuickBooks online and […]

Retained Earnings Formula: A Quick Guide for Businesses

Retained earnings also called net profits of a company choose to keep after paying dividends to shareholders. It plays a key role in funding growth initiatives for research and development. It also improves financial stability by paying down the debt. Retained earnings are present on the balance sheet under shareholder’s equity at the end of […]

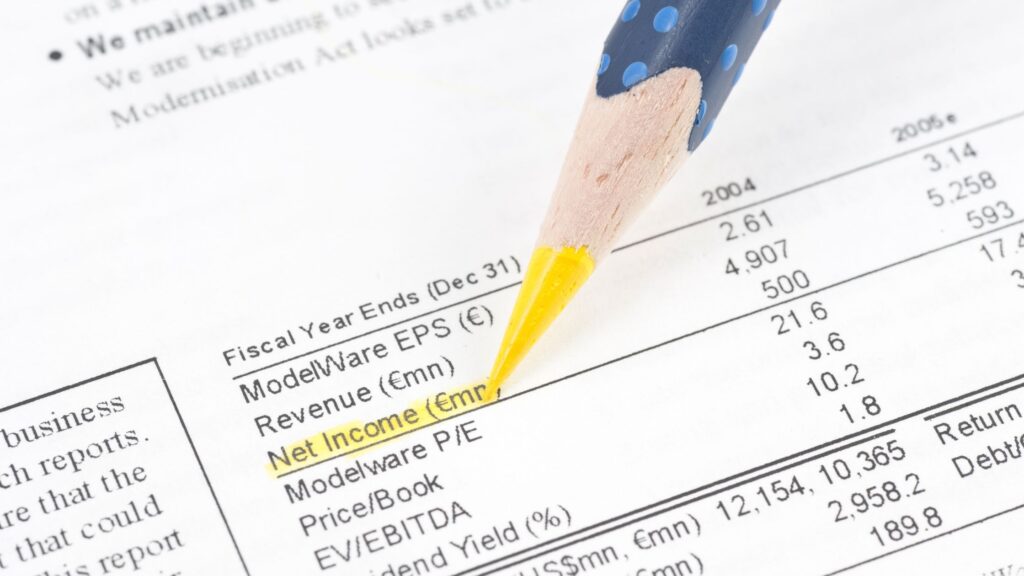

A brief on how to solve net income

Net income, also known as net profit, plays a crucial role in calculating profit and loss statements by showing what the business has earned after accounting for expenses such as taxes, cost of goods sold, and overhead.Here comes the main answer to your concerns, which is how to solve net income, which shows how the […]

Did you overlook something on a prior tax return?

It is not uncommon to discover that an item of income was overlooked, a deduction was not claimed, or that an amended tax document was received after the tax return was already filed. Regardless of whether the oversight will result in more tax due or a refund, it should not be dismissed. Failing to report […]