Managing cash flow helps in giving insights to a business along with its performance and flexibility. Additionally, strong cash flow statements allow businesses to take advantage of opportunities in a quicker and surplus way back to business making it profitable and more stable. A cash flow statement helps in operating, investing, financial activities and income statements showing the profitability of a company under its accrual and accounting rules. Whereas, the balance sheet shows the assets, liabilities, and equity of a company.

Furthermore, in this blog, we will understand what is a cash flow statement and how does statement of cash flows.

Table of Contents

ToggleWhat is a Cash Flow Statement?

A cash flow statement helps in tracking the flow of cash. This means the inflow and outflow provide insights into a company’s health and its operational efficiency. The CFS helps in managing a company’s cash position and its flow. Specifically showing its debt obligation and how operating expenses are to be funded. The main significance of a cash flow statement is to provide information. On non-cash activities and explain the financial condition of the company.

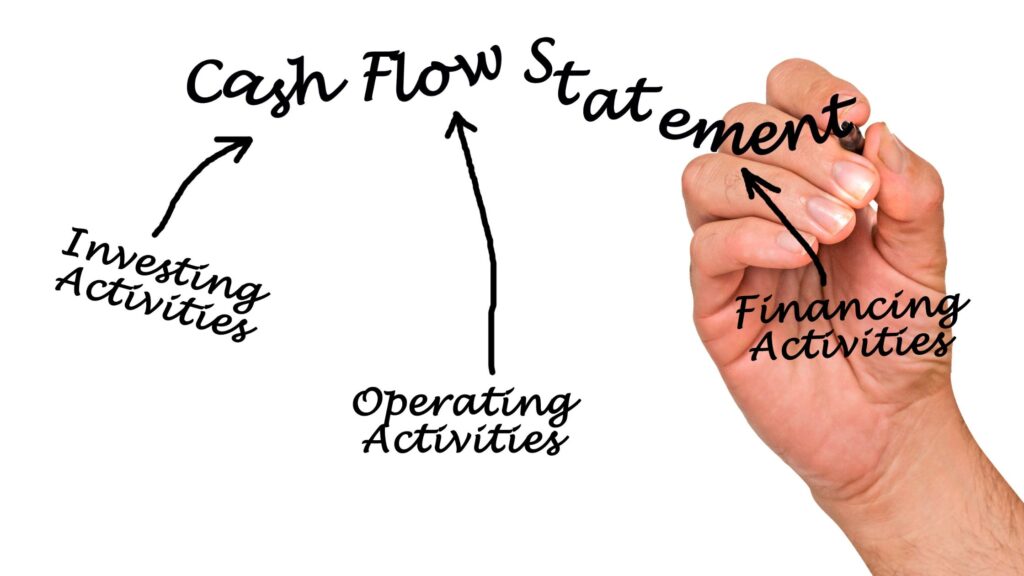

Key Components of a Cash Flow Statement

- Operating Activities: In a cash flow statement, operating activities are the items that are used in the daily activities of a company, which include selling a product, generating revenues, and performing maintenance activities.

- Investing Activities: The statement of cash flows shows investing activities, which usually mean asset acquisition, cash flow from the sale of property or plant, investment in debt, merger, and so on.

- Financing Activities: financial activities are the flow of cash between owners and creditors showing how the business raises capital and pays back to investors. It includes selling, paying cash dividends and so on.

The Direct vs. Indirect Method of Cash Flow Statements

The indirect method starts with net income and then the noncash items and balance sheet items are adjusted which is simpler and more commonly used. Mostly in larger firms as it is efficient and easy to prepare. Whereas, the direct method like cash inflows and outflows gives a clearer vision. Providing a detailed picture of cash flows in a company.

Pros of the direct method:

- Accuracy: it is more accurate, and you might prefer this over the indirect method as it provides better accuracy. As this method relies on actual cash payments, this method is hence very accurate.

- Better insights: it provides better insights than compared to indirect methods. As it utilises all cash flow statements and operates cash flow sections where the calculations are easy and straight to follow.

Cons to direct method:

- Difficult to scale: tracking each and every transaction might be easy in a small-scale business but when you grow in size and scale. It in turn becomes difficult to deal with and might have some potential drawbacks.

- Inefficient: going with documentation with each transaction makes the business finances more complex than it is and has more errors and complications.

Pros for indirect method:

- Utilised, it’s a common choice for both small and large companies for compliance purposes so even if the company follows a direct method it has to create an indirect repost according to GAAP requirements.

- Build: Accounting professionals mostly preferthis indirect method over the direct method as they’re more prepared.

Cons for indirect method:

- Less insightful: it is less detailed than the direct method and doesn’t provide much insight into net cash flow.

- Inaccuracy: it provides a less accurate depiction of the business’s current cash positioning.

Cash Flow vs. Profit: What’s the Difference?

The difference between a cash flow statement and profit, is that profit shows the amount of money left over for expenses that have been paid. Whereas, cash flow shows the net flow of cash in and out of your business.

Profit shows the amount you have earned after expenses, while cash flow shows the movement of money in and out of your business. It can be profitable on paper, but if the payments are slow, then it can show you high upfront costs and cash flow.

Conclusion

In conclusion, the cash flow statement shows you your business’s health report. They show how much money is coming into your business and help you understand cash flow patterns. Moreover, by analysing cash flow statements you can identify where you need to increase or decrease expenses. Here at Freedomfolio, we can help you analyse your cash flow statement and answer all your doubts and questions regarding cash flow statements or statements of cash flows. You should regularly review their cash flow statements and take actionable steps to improve your financial management.

FAQ Section

What is the need of a cash flow statement?

This statement helps in tracking the inflow and outflow of cash, which helps in providing insights. Into a company’s financial and operational efficiency. The CFS helps in managing its cash position and how well the company generates its debt obligation and funds its cash operation.

How cash flow statement is different from the income statement?

Cash flow is more focused on the cash inflows and outflows. Whereas the income statement is based on accounting principles and includes non-cash items like revenue, depreciation, tax payable, and so on.

What is indirect method of cash flow statement preparation?

The indirect method involves the adjustment of the net income along with changes in the balance sheet with the amount of cash generated by operating activities.

Which businesses need to prepare a cash flow statement?

A cash flow statement is required to be created by all companies, however, if they have certain exemptions by OPC in respect to cash flow statements.