Every go-getting entrepreneur and business owner needs a 13-week cash flow.

You need to have a projection and understanding of your business’s financial stature. In the past, it was just enough to rely on the profit and loss balance sheet. However, in recent times, businesses have outgrown the profit and loss balance sheet scope, which does not tell the whole story of your business’s financial health.

The 13-week Cash Flow model is designed to make up for these deficiencies and give business owners a thorough picture of their finances, thereby allowing for accurate and informed financial decisions that aid the sustenance and growth of their businesses.

With the 13-week Cash Flow model, business owners with or without an in-house accounting team now have a simplified tool that handles important financial operations such as budgeting, forecasting, and a simple cash flow model.

After years of expertly guiding entrepreneurs and business owners, we’ve delved deep into the most pressing cash flow challenges they face.

Here are some of the complaints we hear at Freedomfolio all the time:

– My business shows I am making a profit, but I never have any cash,

– I feel like I don’t know what’s going on with my money,

– I want to plan better and have more financial control

CASH IS KING, and if you don’t have a plan for it you are in trouble! Another saying goes: HOPE is NOT a strategy – so PLAN!!!

13-Week Cash Flow with simple Exercise

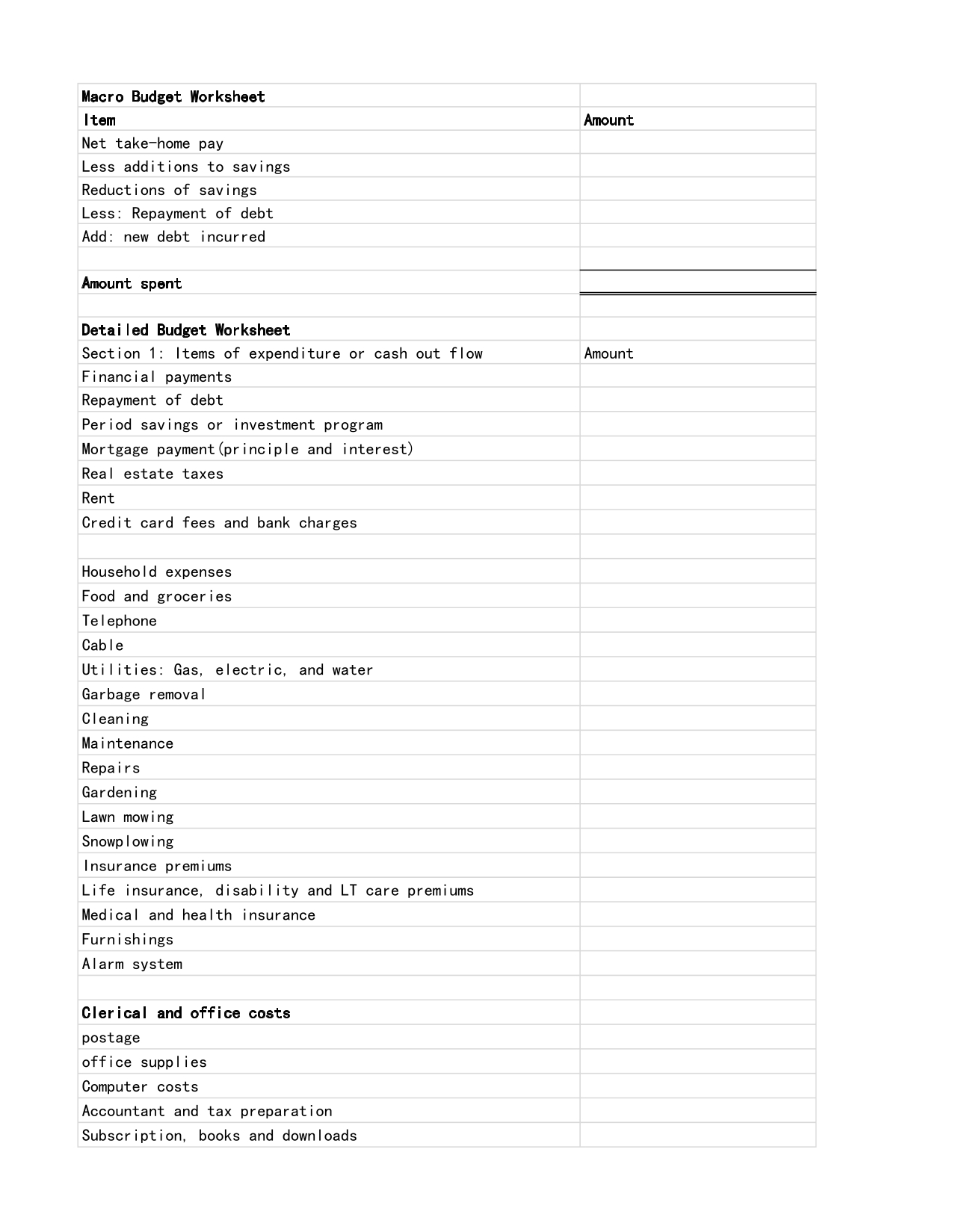

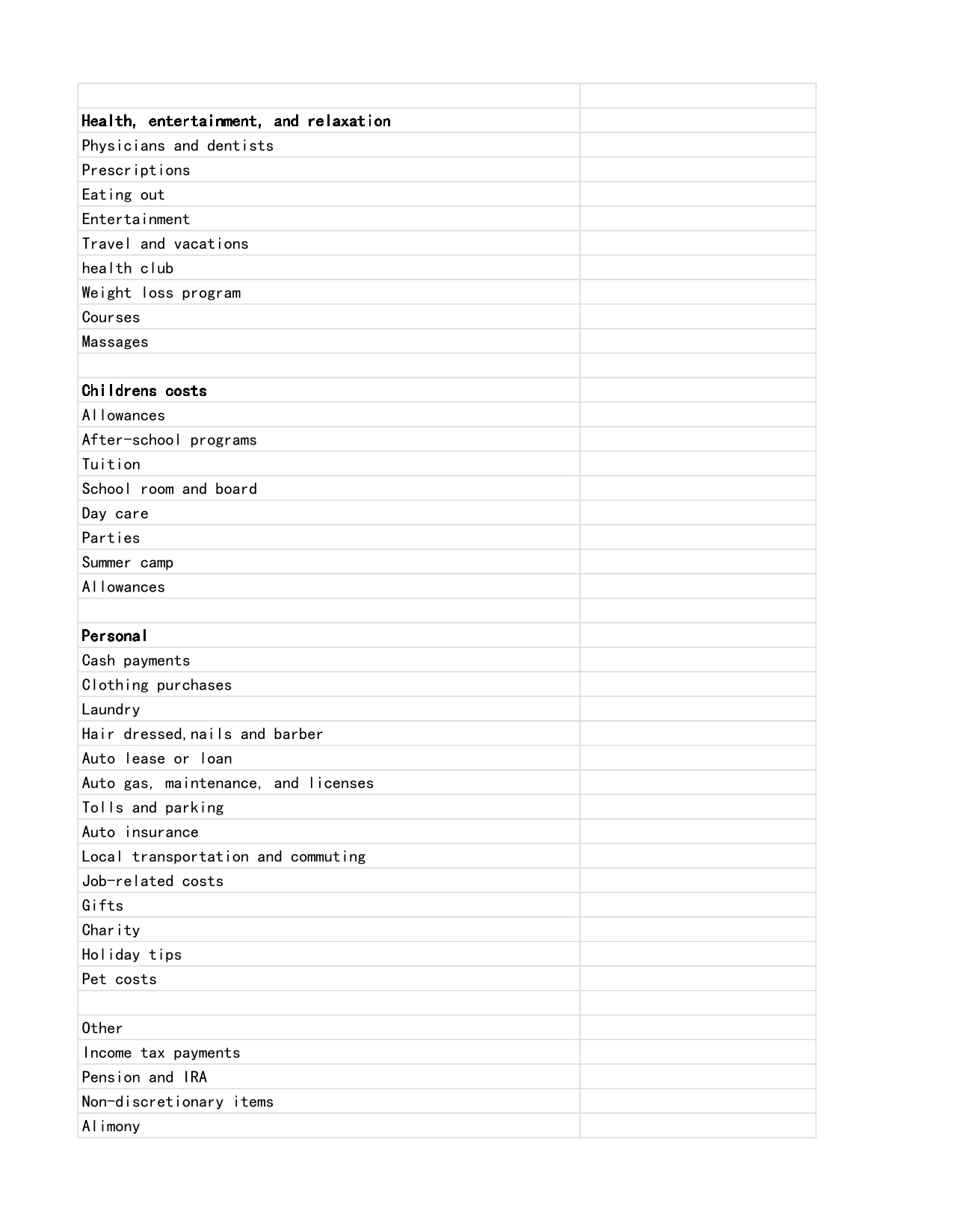

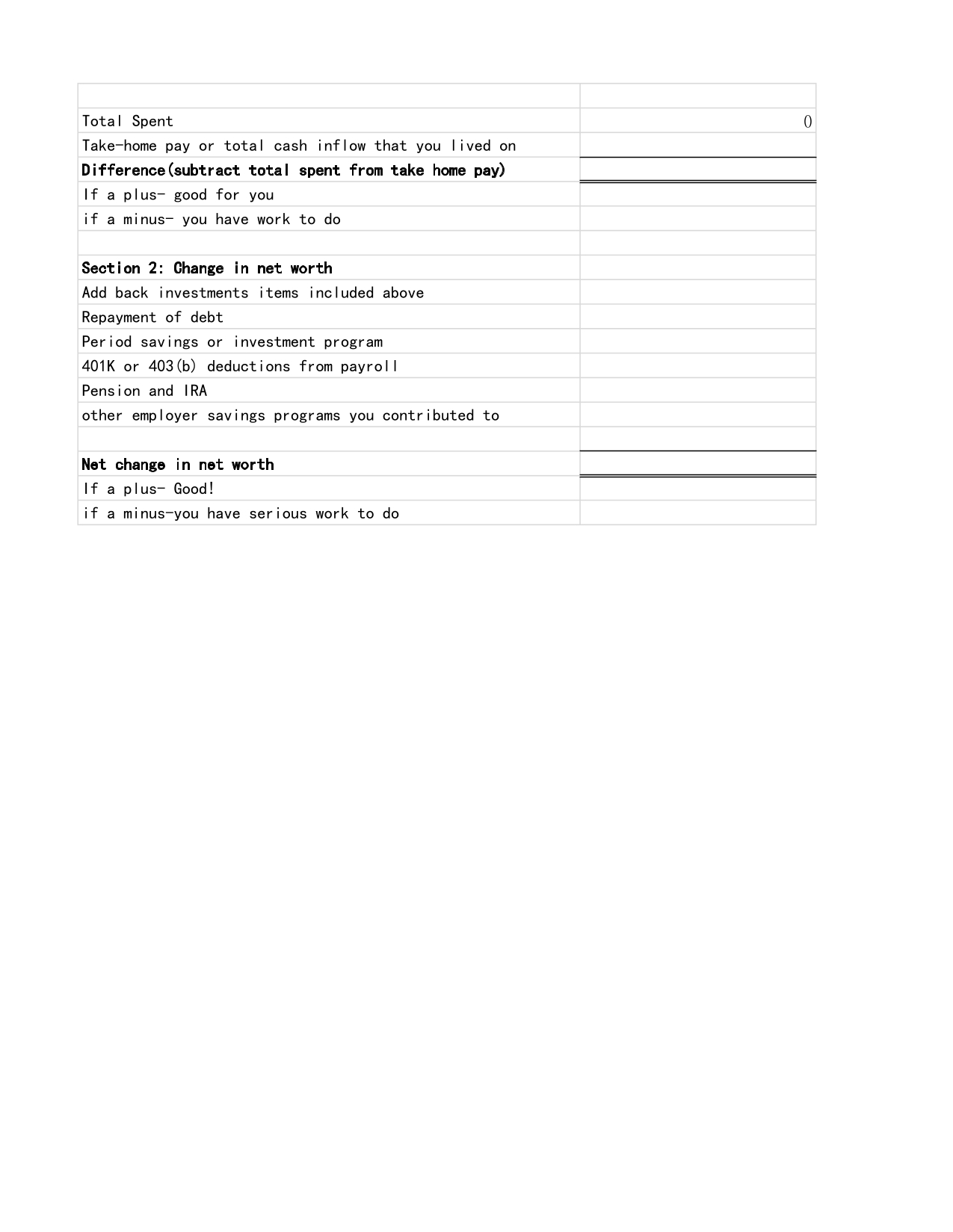

Personal Cash Flow worksheetFollowing are worksheets for two days to create a personal cash flow statement and a detailed budget with every major category of expenses accounted for.

I recommend filling it out as carefully as possible to get a clear picture of your current

spending patterns before a plan can be put together.

This process involves analyzing where your money goes each month and identifying areas where you can make adjustments to improve your financial situation.Why Understanding Cash Flow is Important Financial Awareness:

By tracking your income and expenses, you’ll have a clear picture of your financial habits and be more aware of how you manage your money.

Budgeting: Understanding your cash flow helps you create a realistic budget that aligns with your financial goals and lifestyle. Debt Management: Identifying unnecessary expenses allows you to allocate more funds toward paying off debt, which can improve your credit score and reduce financial stress.

Savings and Investments: By optimizing your cash flow, you can free up resources to save for future needs or invest in opportunities that can grow your wealth.

How to Analyze Your Cash Flow Track Your Income: List all sources of income, including salary, bonuses, rental income, etc.

Record Your Expenses: Categorize your expenses into fixed (rent/mortgage, utilities, insurance) and variable (groceries, entertainment, dining out).

Compare Income and Expenses: Calculate the difference between your total income and total expenses to see if you have a surplus or a deficit. Identify Patterns: Look for spending patterns or areas where you can cut back to increase your savings or reduce debt.

Next Steps

To assist you with this exercise, I’ve attached a simple cash flow worksheet for you to fill out. Please take some time to complete it and let me know if you have any questions or need further assistance. We can also schedule a meeting to go over your findings and discuss strategies for optimizing your cash flow. By taking this proactive step, you’ll gain valuable insights into your financial situation and be better equipped to make informed decisions that support your long-term financial well-being.

Following is a two-minute budget worksheet

Cashflow budget template