A Structured Start → A Confident Future

Your First 90 Days with Freedomfolio

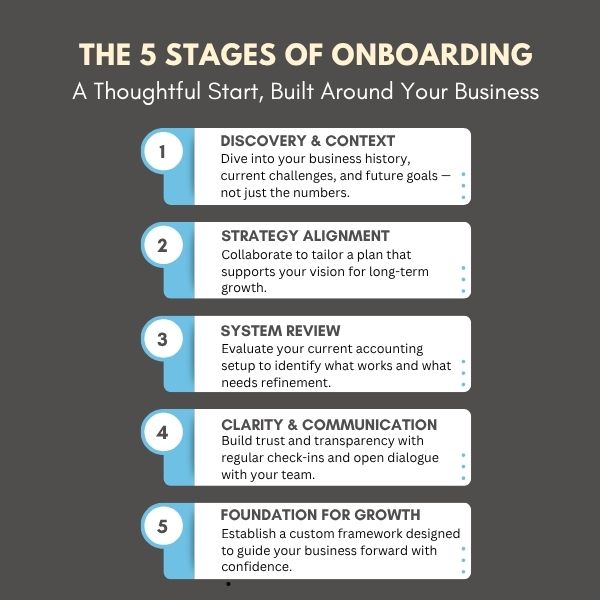

The 5 Stages of Onboarding

A Thoughtful Start, Built Around Your Business

Most firms rely on the “Same As Last Year” approach — repeating the past without questioning if it’s right for your future. At Freedomfolio, we take a different path.

Our 90-day onboarding process is designed to understand you — not just your numbers. We dig into your business history, current challenges, and future goals so we can tailor a strategy that supports real, lasting growth.

This structured yet collaborative approach helps us build a strong foundation, foster trust, and ensure you feel confident in your accounting team. We’re not just here to check boxes — we’re here to guide your business forward with insight, clarity, and purpose.

Discovery & Diagnostic Call

Where it all begins — understanding you and your business.

Before we dive into numbers, tools, or strategy, we begin with a comprehensive discovery call — your opportunity to share what’s working, what’s not, and what success looks like for you.

Led by your Business Solutions Director, this call sets the stage for the relationship. You’ll walk us through your operations, goals, team structure, and biggest financial challenges.

We’ll listen closely, identify urgent needs, and outline your custom roadmap. Whether you’re managing a real estate portfolio, an eCommerce brand, or a service-based business, we tailor our approach from the very start.

Deliverables Following This Call:

- Business structure and ownership review

- Identification of key decision-makers and stakeholders

- Understanding of current bookkeeping/tax setup

- Prioritization of pain points and quick wins

- Clarification of long-term financial goals

- Secure portal onboarding

This first conversation is all about clarity. When we understand your world, we can build solutions that actually work for you.

Chart of Accounts Customization & Setup

Organizing the core of your financial system.

A clean Chart of Accounts (COA) is the foundation of accurate financial reporting. We’ll either restructure your existing COA or create a new one — tailored specifically to your business model, industry, and decision-making needs.

No more vague categories or uncategorized transactions. Every dollar will have a home, and every report will tell a story.

Key Focus Areas:

- Revenue stream separation (by service, product, or location)

- Expense categorization for meaningful margin analysis

- Direct vs. indirect cost clarity

- Asset and liability mapping

Industry-specific custom tags or classes (e.g., properties, SKUs, partners)

Expect an intuitive, intelligent financial framework — one you can trust and act on.

Tax Strategy Consultation

A proactive plan to minimize your tax liability — before the year ends.

Most tax savings happen before you file. That’s why our tax strategy consultation happens early in the engagement — often before any compliance work begins.

Together with our tax professionals, you’ll review your current entity setup, income streams, and deductions. From there, we’ll recommend high-impact strategies personalized to your situation.

What We Explore:

- Optimal business entity selection (LLC, S Corp, etc.)

- Tax-efficient compensation planning (W-2, draws, distributions)

- Real estate depreciation, cost segregation, and passive income strategies

- Retirement plan tax benefits (Solo 401k, SEP IRA, etc.)

- Business deductions you’re missing out on

- Tax credit eligibility

We don’t just help you file taxes — we help you pay less of them, legally and ethically.

Monthly Bookkeeping Workflow

Your financial records — handled with precision and consistency.

With your accounts integrated and your COA finalized, our bookkeeping team gets to work.

Every month, we reconcile your bank, credit card, and loan accounts, ensure accurate categorization, and update your financial dashboards. You’ll know where your money is — and where it’s going — with dependable monthly reports.

Includes:

- Full monthly reconciliation

- Categorization of all transactions

- Real-time cloud access to reports (via QBO or Xero)

- Monthly balance sheet + P&L

- Clear documentation of any uncategorized or flagged items

- Audit trail and compliance review

Our approach isn’t just “clean books” — it’s decision-ready financials.

Backwork & Clean-Up Projects

Bringing old books up to speed — fast.

If your historical financials are messy, outdated, or inaccurate (and let’s be honest — they often are), our team goes into clean-up mode.

We tackle months — even years — of backlog, correcting errors, identifying misclassifications, and getting you fully caught up.

Backwork often includes:

- Correction of miscategorized income/expenses

- Duplicate or missing entry resolution

- Bank and loan reconciliation

- Sales tax liability checks

- Rebuild of missing reports or QBO files

- Amended returns where necessary

This isn’t just a fix — it’s a reset. We make sure your books are audit-proof and tax-ready.

Strategic Financial Review

Quarterly insight sessions to keep you aligned and on track.

Once the day-to-day financials are flowing, we step back to help you see the big picture. Your dedicated Client Manager will meet with you quarterly to review performance, track KPIs, and identify trends.

We cover:

- Year-to-date profitability

- Cash flow insights

- Margin performance by product/service

- Burn rate (for startups)

- Debt and liability management

- Forecasting and budgeting checkpoints

These sessions aren’t about spreadsheets — they’re about smart decisions. We translate numbers into clear, actionable insights.

Entity Formation & Compliance

Start with the right structure — and stay compliant.

Whether you’re launching a new venture or restructuring an existing business, we ensure you’re set up legally, strategically, and efficiently.

We help with:

- LLC and S Corp formation

- EIN registration and operating agreements

- Multi-entity structuring for real estate investors

- Annual report filings and compliance tracking

- Registered agent services

Your structure has tax and liability implications — we’ll get it right from the start.

Address: 53 State Street Suite 500, Boston MA 02109

Phone: (781) 309-6778